State Of Compliance Within Financial Institutions

Experience

89%

of users have not had a good KYC experience, 13% change FIs as a result

Source Forbes Technology Council

Cost

$2,598

is the average cost to complete a KYC review for a corporate client

Source The Fintech Times

Change

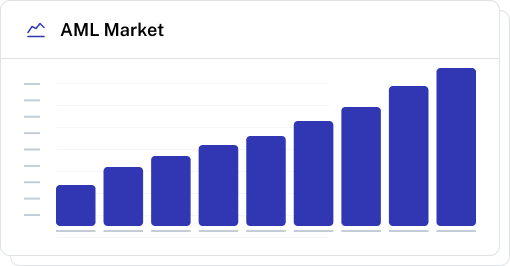

15.6%

CAGR growth expected in the AML market despite global skill shortage

Source Grand View Research

Qkvin is an end-to-end solution that offers digital identity, onboarding, ongoing monitoring and decisioning for Financial Institutions. It accelerates the onboarding of individuals and companies, empowers ongoing monitoring across the client lifecycle to deliver better customer experience, optimises cost, and strengthens overall regulatory compliance with changing requirements. Qkvin is built on modern technologies, improves operational efficiencies and helps mitigate risks by leveraging automation and AI/ML.

Qkvin is an end-to-end solution that offers digital identity, onboarding, ongoing monitoring and decisioning for Financial Institutions. It accelerates the onboarding of ind

Connecting The Right Dots For Compliance

Challenges in Compliance

Qkvin's Solutions

Duplicated antiquated workflows

Guided workflows optimised for reuse

Manual monitoring

AI/ML driven real-time monitoring

Slower adoption of regulations

Customised policies aligned to your strategy

Complex user registration

Seamless user onboarding

Time consuming risky migrations

Safe, repeatable, automated migrations (powered by TerraAi)

Connecting The Right Dots For Compliance

Challenges in Compliance

Qkvin's Solutions

Challenges Within Compliance

Incorporating modern technologies that utilise AI/ML and automation for data gathering, risk analysis, and insight generation, is crucial for satisfying regulatory compliance requirements in financial institutions.

Challenges Within Compliance

Our Solutions

Qkvin's digital identity revolutionises how customers interact with your organisation, while ensuring safety and security. Every customer that Qkvin onboards is assigned a Qkvin ID after successful verification. The Qkvin ID is built with sharing in mind and enables you to leverage client profiles across departments or entities within your organisation. Qkvin empowers you to leverage the Qkvin ID for an efficient identity verification.

Transform client onboarding and efficiently manage client lifecycle events and ongoing compliance with Qkvin. Digitise and automate end-to-end processes, eliminating paperwork and reducing time-to-onboard with Qkvin’s seamless journeys. Optimise data collection with digital forms and API integration, ensuring accuracy and minimising manual effort using enhanced data capture. Enable continuous monitoring that efficiently tracks client changes and updates to KYC/KYB information.

Client Onboarding

Know Your Customer (KYC)

Know Your Business (KYB)

Life Events

Qkvin ensures ongoing client monitoring and regulatory compliance from onboarding throughout the client lifecycle. Automated tracking detects life events, changes in circumstances, and suspicious activity across integrated systems and third-party feeds. Updates to KYC/AML information occur automatically, minimising errors and manual tasks. Case management provides visibility into changes, empowering analysts and leads to assess the impact on risk profiles. Advanced algorithms conduct dynamic risk assessments in real-time, enabling timely interventions.

Transaction Monitoring

Ongoing Screening

Account Management

Staying ahead of evolving regulations can feel daunting; Financial institutions face a constant barrage of compliance obligations, ranging from KYC/AML and transaction monitoring to sanctions screening and adverse media checks. Failing to meet these requirements can result in fines and reputational damage. Qkvin is your trusted partner in navigating this complex landscape. We offer comprehensive tools and features to streamline your compliance journey.

Financial institutions must constantly prioritise stability, requiring cautious use of modern technologies. While migration risks are imminent, the benefits of modernisation are too substantial to ignore, making migrations necessary for every financial institution in a sensitive and regulated environment. However, migrations present a multitude of challenges for organisations, spanning years and consuming valuable time and resources while posing risks of project delays, budget overruns, and operational disruptions.

Our Partner Network

Simplifying Client Lifecycle Management

Evaluating individual and institutional information for seamless onboarding and ongoing risk management necessitates using modern practices and data-driven insights. Provide excellent user experience alongside best-of-breed compliance empowerment solutions at every step of the lifecycle with Qkvin.

Qkvin efficiently automates customer verification processes, risk assessment, decisioning, ongoing monitoring, reporting, dashboards and migration to help you utilise your compliance talent using modern technologies. Qkvin's risk dashboards, configurable checks, and dynamic policies elevate GRO oversight to transform risk posture and strengthen regulatory reporting.

Evaluating individual and institutional information for seamless onboarding and ongoing risk management necessitates using modern practices and data-driven insights. Provide excellent user

Clients can use a white-labelled and API-enabled onboarding experience that helps digitise data capture, providing a better, streamlined onboarding

Personal Details

Company Information

Bank Accounts

Beneficiaries

Related Parties

Tax Information

Verify identities and documents using Artificial intelligence to perform liveness and signature checks

Photo ID verification

Signature

Liveness checks

Perform KYC/KYB checks including Address, enhanced due diligence tailored to your needs through our configurable policies

Beneficiaries

Country

Industry

Address

PEPs, Sanctions and Adverse media

Automated risk profiling and decisioning based on customised rules for your organisation(s) as well as jurisdiction-based rules and regulations

Guided Workflow

Policy Based Assessments

AI/ML Integrations

Perform scheduled and on-demand checks based on risk profile, ongoing transaction monitoring, automated alerts & notifications, account locks and blocks

Adverse Media

Sanctions

PEPs

Transaction Monitoring

Manage ongoing changes to circumstances of individuals and institutions due to life events and/or corporate changes

Name Change

Address Change

Related Parties

Company Changes

Beneficiary/Signatory change

New accounts

Sectors We Operate In

Wealth Management

Qkvin revolutionises onboarding and ongoing monitoring for Wealth Managers by seamlessly integrating regulatory compliance with an unparalleled client experience. Facilitating faster onboarding, identifying beneficial owners within complex structures and reduced costs through automation ensures a competitive edge tailored to each firm's unique needs.

Qkvin revolutionises onboarding and ongoing monitoring for Wealth Managers by seamlessly integrating regulatory compliance with an unparalleled client experience. Facilitating faster onboa

Asset Management

Qkvin redefines efficiency and adaptability amidst manual compliance challenges for asset managers. Our solution offers customisable policies for regulatory alignment to meet a broad range of risk profiles and investment objectives. A streamlined onboarding experience and client-centric dashboards for real-time monitoring ensure a seamless, accelerated client onboarding experience and enhanced operations.

Qkvin redefines efficiency and adaptability amidst manual compliance challenges for asset managers. Our solution offers customisable policies for regulatory alignment to meet a broad range

Banking

The banking sector typically sees large volumes and constant stream of transactions along with high customer expectations. Qkvin automates rigorous checks, ensuring seamless adherence to evolving regulations, complemented by secure document and ID & Verification for authenticity. Real-time monitoring offers insights into transactions and consumer activity, while customisable policies cater to unique compliance needs, empowering banks with efficiency in the face of regulatory challenges and high customer expectations.

The banking sector typically sees large volumes and constant stream of transactions along with high customer expectations. Qkvin automates rigorous checks, ensuring seamless adherence to e

Fund Administration

Fund Administrators are constantly under pressure due to evolving regulations, cost and resource constraints. Qkvin reduces paperwork through a comprehensive digital onboarding process, transforms due diligence challenges, and enables you to review your risk against potential threats. Qkvin's configurable policies and risk engine redefine efficiency, with an API-first design integrations. The use of AI/ML enables fund administrators to enhance efficiency, improve risk management, and empower better regulatory compliance.

Fund Administrators are constantly under pressure due to evolving regulations, cost and resource constraints. Qkvin reduces paperwork through a comprehensive digital onboarding process, tr

Sectors We Operate In

Qkvin revolutionises onboarding and ongoing monitoring for Wealth Managers by seamlessly integrating regulatory compliance with an unparalleled client experience. Facilitating faster onboarding, identifying beneficial owners within complex structures and reduced costs through automation ensures a competitive edge tailored to each firm's unique needs.

Qkvin redefines efficiency and adaptability amidst manual compliance challenges for asset managers. Our solution offers customisable policies for regulatory alignment to meet a broad range of risk profiles and investment objectives. A streamlined onboarding experience and client-centric dashboards for real-time monitoring ensure a seamless, accelerated client onboarding experience and enhanced operations.

The banking sector typically sees large volumes and constant stream of transactions along with high customer expectations. Qkvin automates rigorous checks, ensuring seamless adherence to evolving regulations, complemented by secure document and ID & Verification for authenticity. Real-time monitoring offers insights into transactions and consumer activity, while customisable policies cater to unique compliance needs, empowering banks with efficiency in the face of regulatory challenges and high customer expectations.

Fund Administrators are constantly under pressure due to evolving regulations, cost and resource constraints. Qkvin reduces paperwork through a comprehensive digital onboarding process, transforms due diligence challenges, and enables you to review your risk against potential threats. Qkvin's configurable policies and risk engine redefine efficiency, with an API-first design integrations. The use of AI/ML enables fund administrators to enhance efficiency, improve risk management, and empower better regulatory compliance.

Featured Content

Strengthening AML Financial Crime Controls: A Comprehensive Approach

Source: Qkvin

Empowering Compliance Teams: Guided Workflows to Navigate Talent Crunch

Source: Qkvin

From Manual to Machine: How Automation is Reshaping Ongoing Monitoring

Source: Qkvin

Strengthening AML Financial Crime Controls: A Comprehensive Approach

FCA's warning on common control failings in AML frameworks, and areas of improvement to prevent FinCrime.

Source: Qkvin

Empowering Compliance Teams: Guided Workflows to Navigate Talent Crunch

The need for comprehensive CLM in compliance as the demand for skilled professionals outstrips supply.

Source: Qkvin

From Manual to Machine: How Automation is Reshaping Ongoing Monitoring

Understanding the role of automation in building modern ongoing monitoring processes for compliance.

Source: Qkvin