Streamline Business Verification

Streamline Business Verification

Qkvin features advanced AI/ML solutions for seamless risk assessment, screening and document verification. Qkvin delivers a comprehensive suite of tools that help ensure accuracy, compliance, and a digital-first approach to mitigate potential risks and fraudulent activities with automated KYB.

Qkvin features advanced AI/ML solutions for seamless risk assessment, screening and document verification. Qkvin delivers a comprehensive suite of tools that help ensure accuracy, compliance, and a digital-first approach to mitigate potential risks and fraudulent activities with automated KYB.

Key Pillars

Faster Entity Onboarding

Qkvin accelerates client onboarding, leveraging AI/ML to swiftly analyse and verify business information. It reduces onboarding times and facilitates prompt integration.

Qkvin accelerates client onboarding, leveraging AI/ML to swiftly analyse and verify business information. It reduces onboarding times and facilitates prompt integration.

Proactive Risk Oversight

Qkvin's advanced algorithms provide real-time risk monitoring and empowers businesses to proactively address threats. It ensures better compliance and helps safeguard against fraudulent activities.

Qkvin's advanced algorithms provide real-time risk monitoring and empowers businesses to proactively address threats. It ensures better compliance and helps safeguard against fraudulent activities.

Seamless Integration

Qkvin's user-friendly interface and seamless integration simplify the incorporation of AI/ML-powered KYB, allowing businesses to adapt quickly without extensive training or system overhauls.

Qkvin's user-friendly interface and seamless integration simplify the incorporation of AI/ML-powered KYB, allowing businesses to adapt quickly without extensive training or system overhauls.

Key Pillars

Embrace Robust KYB with Qkvin

Embrace Robust KYB with Qkvin

Stay ahead of regulatory changes effortlessly as our agile platform adapts to evolving compliance requirements. Streamline your operations, enhance customer experience, and fortify risk management with our innovative digital KYB solution. Embrace the future of business verification with confidence and efficiency.

Stay ahead of regulatory changes effortlessly as our agile platform adapts to evolving compliance requirements. Streamline your operations, enhance customer experience, and fortify risk management with our innovative digital KYB solution. Embrace the future of business verification with confidence and efficiency.

Feature Showcase

Qkvin's KYB process introduces a self-service onboarding system, empowering businesses with streamlined automation. This innovative approach reduces manual intervention and delivers a seamless and efficient client onboarding experience.

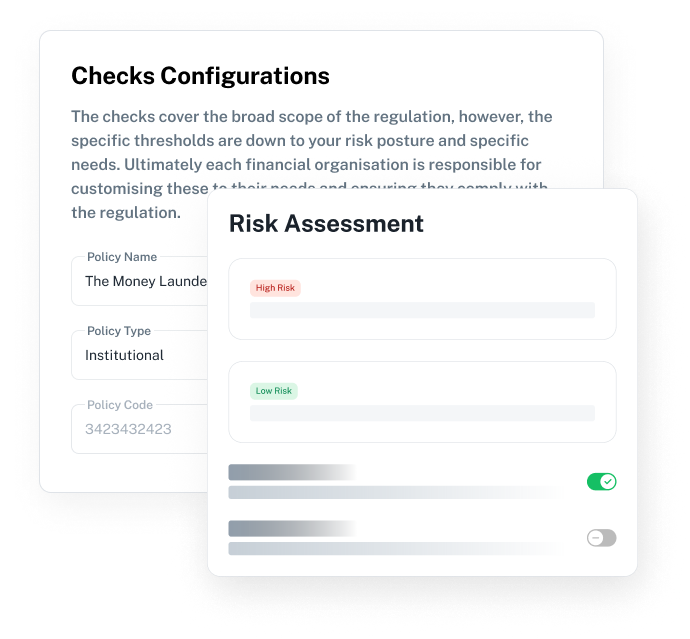

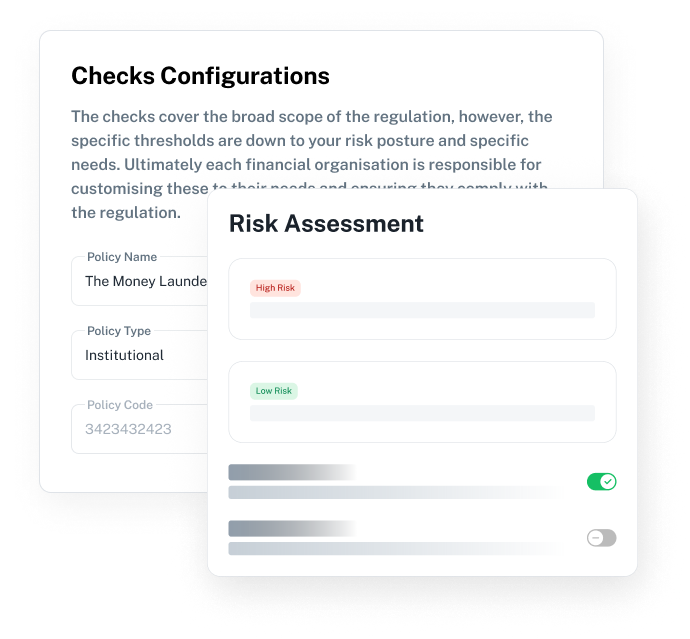

Qkvin leverages advanced Artificial Intelligence and Machine Learning algorithms for dynamic risk assessment. This cutting-edge technology enhances decision-making accuracy and allows businesses to confidently navigate compliance challenges and safeguard against potential risks.

Qkvin's KYB process incorporates automated screening solutions, ensuring a thorough examination of the entities involved. The system offers a comprehensive approach to due diligence from meticulous document verification to beneficiary identity screening that minimises the risk of fraudulent activities.

Qkvin excels in company registry lookup and verification. It swiftly validates registration details, incorporation dates, and other relevant information for businesses to reliably confirm the authenticity of their partners and associates.

Qkvin delivers unparalleled speed and accuracy in proof of address verification. This crucial step adds a layer of risk mitigation, fortifying KYB compliance and effectively eliminating vulnerabilities to fraudulent activities.

Qkvin's digital-first strategy for bank account verification ensures the authenticity of company and beneficiary accounts. This approach enhances the accuracy of information and aligns with contemporary digital practices which reduce the risk associated with traditional methods.

Qkvin's KYB process goes beyond conventional checks with comprehensive screening for politically exposed persons (PEPs), sanctions, and adverse media as well as life events. This robust screening identifies high-risk beneficiaries and flags potential financial crime involvements to provide businesses with invaluable risk insights.

Qkvin helps businesses adhere to international regulatory standards with meticulous compliance to FATCA/CRS declarations. This commitment to regulatory requirements ensures that businesses remain in good standing, mitigating risks associated with non-compliance.