Benefits You Can Expect

Reliable Verification

Utilise secure and reliable data sources for verification, minimising errors and reduce fraudulent activities.

Utilise secure and reliable data sources for verification, minimising errors and reduce fraudulent activities.

Faster Decision-Making

Automated risk scoring based on verified digital identity data facilitates quicker and more informed decisions about customer onboarding and transaction approvals.

Automated risk scoring based on verified digital identity data facilitates quicker and more informed decisions about customer onboarding and transaction approvals.

Streamlined Onboarding

Verifying identities online through trusted data sources like e-government databases or digital signatures significantly reduces paperwork and manual checks, speeding up customer onboarding.

Verifying identities online through trusted data sources like e-government databases or digital signatures significantly reduces paperwork and manual checks, speeding up customer onboarding.

Global Reach

Access to international databases and digital identity providers makes verifying identities across countries and regions easier.

Access to international databases and digital identity providers makes verifying identities across countries and regions easier.

Reduced Costs

Eliminating physical documents, manual data entry, and physical document storage leads to significant cost savings for financial institutions.

Eliminating physical documents, manual data entry, and physical document storage leads to significant cost savings for financial institutions.

Enhanced Security

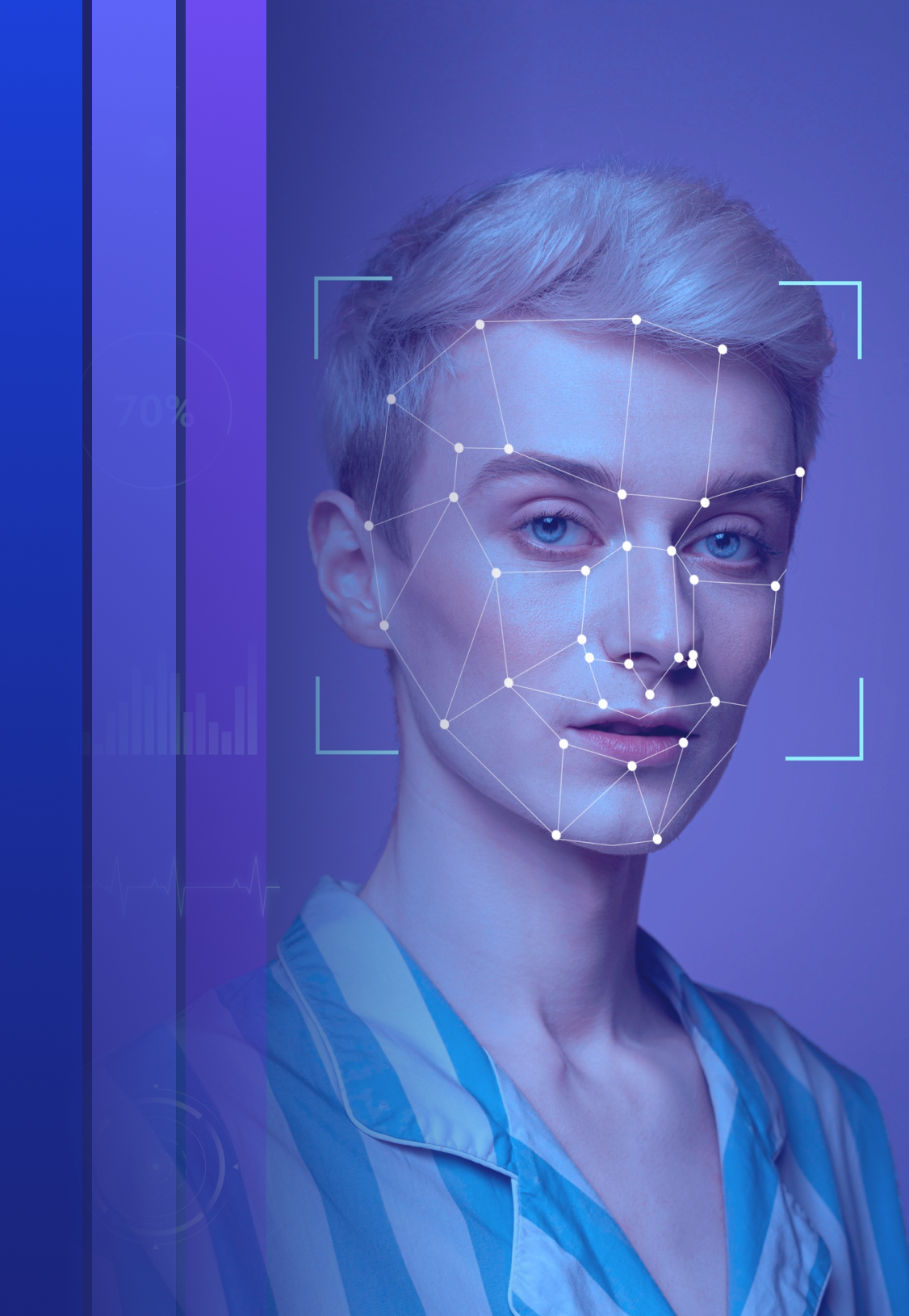

Utilise advanced technologies such as liveness detection and encryption for robust identity authentication.

Utilise advanced technologies such as liveness detection and encryption for robust identity authentication.

Benefits You Can Expect

Feature Showcase

Connect with multiple providers for comprehensive identity verification.

Integrate our automated workflows seamlessly with your existing KYC/AML processes for smooth onboarding and ongoing monitoring.

Adhere to the latest KYC/AML regulations and data privacy requirements.

Leverage AI and machine learning to assess risk based on verified digital identity data.