Digitise and Transform Client Onboarding

Digitise and Transform Client Onboarding

Qkvin accelerates onboarding individuals and companies by leveraging modern technologies, automation and AI/ML-powered transformation.

Qkvin's technology elevates compliance and risk management by enabling adherence to the most stringent KYC/AML regulations, promoting robust due diligence and helping to safeguard your organisation against financial crime.

Qkvin accelerates onboarding individuals and companies by leveraging modern technologies, automation and AI/ML-powered transformation.

Qkvin's technology elevates compliance and risk management by enabling adherence to the most stringent KYC/AML regulations, promoting robust due diligence and helping to safeguard your organisation against financial crime.

Key Pillars

Optimise Onboarding with Unparalleled Efficiency

Qkvin's digital platform facilitates smooth onboarding powered with process automation for a superior experience with fewer touchpoints, streamlining data capture and automating workflows. Achieve enhanced process control and expedite time-to-onboard while mitigating operational risks.

Qkvin's digital platform facilitates smooth onboarding powered with process automation for a superior experience with fewer touchpoints, streamlining data capture and automating workflows. Achieve enhanced process control and expedite time-to-onboard while mitigating operational risks.

Tailor Your Experience Using Our Efficient APIs

Build a bespoke onboarding solution that seamlessly integrates with your existing infrastructure. Design brand-aligned experiences or leverage our white-labelled platform for immediate implementation. Our pre-defined configurable workflows eliminate information silos and promotes coordinated communication, equipping new users with the tools to thrive.

Build a bespoke onboarding solution that seamlessly integrates with your existing infrastructure. Design brand-aligned experiences or leverage our white-labelled platform for immediate implementation. Our pre-defined configurable workflows eliminate information silos and promotes coordinated communication, equipping new users with the tools to thrive.

Clear Communication and Transparency

Qkvin includes alert and notification features that enables communication with customers when potential threats arise. Qkvin's messaging system allows customers to be contacted securely for additional information and documentation. This proactive approach keeps everyone informed, facilitates timely resolutions, and strengthens long-term relationships.

Qkvin includes alert and notification features that enables communication with customers when potential threats arise. Qkvin's messaging system allows customers to be contacted securely for additional information and documentation. This proactive approach keeps everyone informed, facilitates timely resolutions, and strengthens long-term relationships.

Key Pillars

Holistic Case Management with Qkvin

Holistic Case Management with Qkvin

Financial Institutions must manage large transaction volumes and identify high-risk customers to protect businesses from non-compliance. Automating case management and checks with Qkvin empowers firms to meet regulatory requirements easily while rapidly detecting and reporting suspicious activities to strengthen security against financial crime.

Financial Institutions must manage large transaction volumes and identify high-risk customers to protect businesses from non-compliance. Automating case management and checks with Qkvin empowers firms to meet regulatory requirements easily while rapidly detecting and reporting suspicious activities to strengthen security against financial crime.

Feature Showcase

Qkvin provides a rich white-labelled interface that helps digitise data capture, providing a superior streamlined onboarding. The platform also enables communication between your clients and compliance teams, including requests for documentation.

Our open API empowers you to integrate our data and functionality with your internal and external systems. Our solution can help you whether you want to create a bespoke branded experience that's uniquely yours or seamlessly blend our capabilities into your existing workflow.

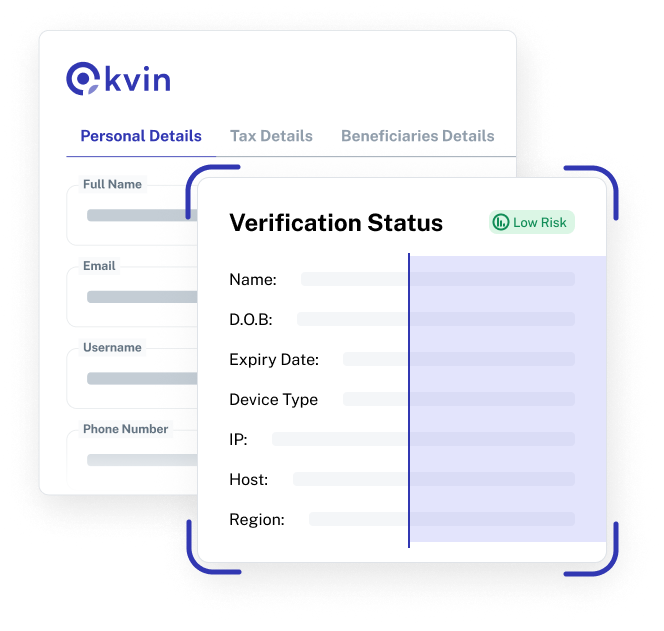

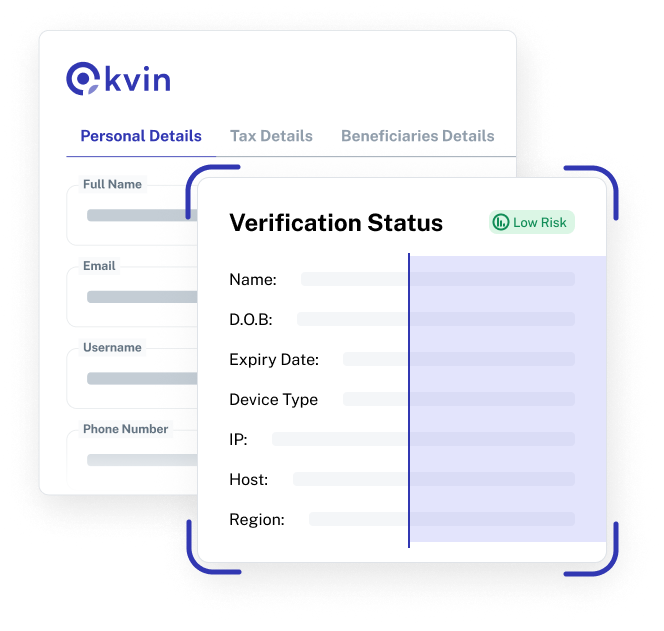

Our case management keeps your investigations organised, efficient, and compliant. Organise tasks, track progress, and keep everything on track – from simple low risk client profiles (individual or institutional) to complex investigations. Access detailed reports, monitor key metrics, and gain real-time insights to make informed decisions with every case.

Qkvin's customisable workflows adapt to the unique needs of your organisation, streamlining case management and ensuring a frictionless experience. Qkvin eliminates confusion through clear instructions, automated notifications, and intuitive interfaces. Our solution integrates seamlessly with existing systems for a unified view of the client journey. Qkvin delivers actionable insights from real-time data to continuously improve onboarding processes and exceed client expectations.

Our risk assessments harness the power of automation and AI to uncover hidden risks. Qkvin's intelligent algorithms analyse real-time information, evaluate the risk profiles, and empower informed decisions.

Our automated migration, powered by TerraAi, gets you up and running quickly, unlocking the full potential of our KYC/AML solution, faster. It also helps you roll out the solution incrementally rather than trying to change everything in one go.