Elevate Your Customer KYC Journey

Elevate Your Customer KYC Journey

Qkvin can transform compliance into a competitive advantage, building trust, mitigating risk, and paving the way for lasting client relationships. Our platform offers guided customisable policies and workflows that are powered by AI/ML transformation for improved compliance and enriched user experience.

Qkvin can transform compliance into a competitive advantage, building trust, mitigating risk, and paving the way for lasting client relationships. Our platform offers guided customisable policies and workflows that are powered by AI/ML transformation for improved compliance and enriched user experience.

Key Pillars

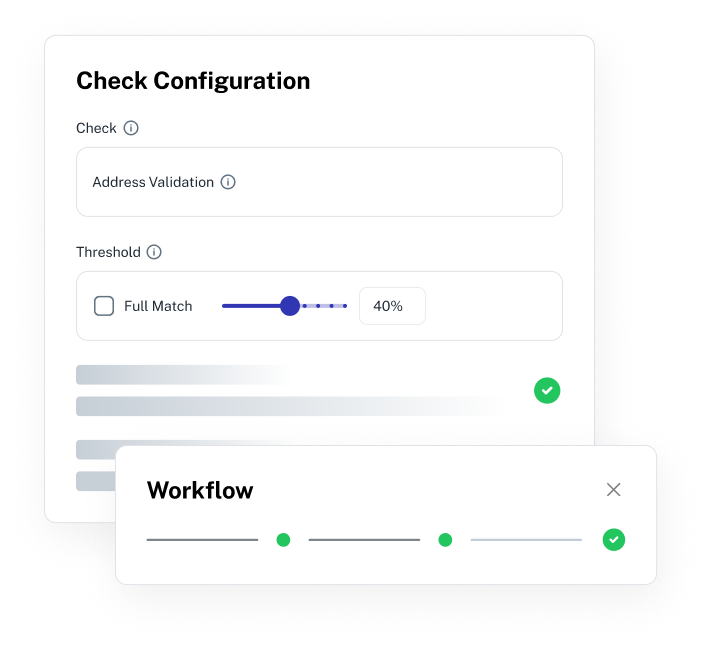

Customisable Policies

Configurable policies and checks allow organisations to flexibly tailor regulatory process with a risk-based approach. Qkvin's policies can easily adapt to specific requirements and risk appetite, as well as streamline workflows based on low and high risk scenarios. Qkvin can scale its policies alongside business growth and regulatory evolution whilst also maintaining auditability and transparency.

Configurable policies and checks allow organisations to flexibly tailor regulatory process with a risk-based approach. Qkvin's policies can easily adapt to specific requirements and risk appetite, as well as streamline workflows based on low and high risk scenarios. Qkvin can scale its policies alongside business growth and regulatory evolution whilst also maintaining auditability and transparency.

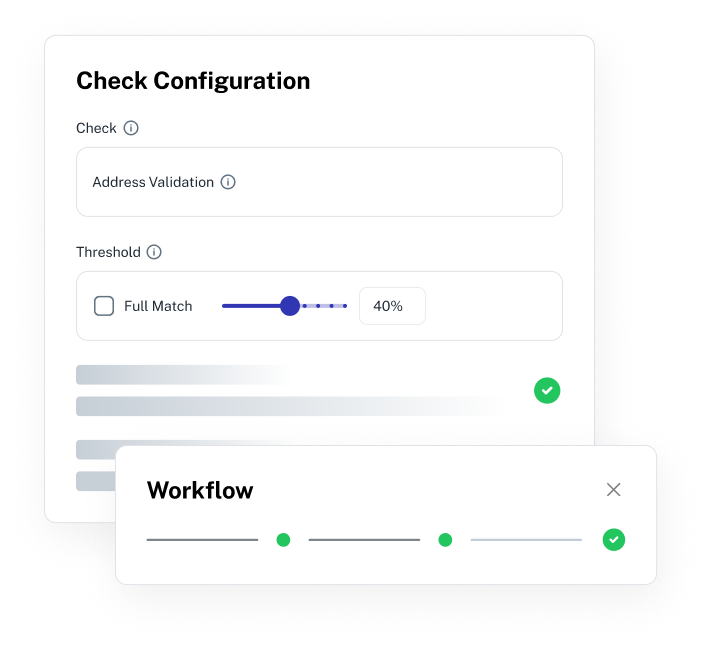

Guided Workflows

Pre-defined configurable workflows within Qkvin can guide compliance teams through key steps, explaining processes, minimising confusion, and securely sharing relevant data between authorised parties. This eliminates information silos, improves collaboration, and promotes coordinated communication which enhances efficiency, reduces misunderstandings, and equips new members with the tools to thrive.

Pre-defined configurable workflows within Qkvin can guide compliance teams through key steps, explaining processes, minimising confusion, and securely sharing relevant data between authorised parties. This eliminates information silos, improves collaboration, and promotes coordinated communication which enhances efficiency, reduces misunderstandings, and equips new members with the tools to thrive.

Ongoing Compliance

Qkvin's technology enables adherence to the most stringent KYC/AML regulations, promoting robust due diligence and safeguarding organisations against financial crime through continuous risk-based monitoring. Qkvin provides real-time alerts and automated reporting to keep organisations well-informed and ensure compliance with evolving regulations.

Qkvin's technology enables adherence to the most stringent KYC/AML regulations, promoting robust due diligence and safeguarding organisations against financial crime through continuous risk-based monitoring. Qkvin provides real-time alerts and automated reporting to keep organisations well-informed and ensure compliance with evolving regulations.

Key Pillars

Feature Showcase

Qkvin comes with predefined screening checks for enhanced due diligence including Identity & Verification, Address, Bank account, PEP, Sanctions and Adverse Media. We can also easily extend this to any custom screenings you would require.

Our risk assessments harness the power of automation and AI to uncover hidden risks. Qkvin's intelligent algorithms analyse real-time information, evaluate the risk profiles, and empower informed decisions.

Navigating the web of ownership structures is a critical yet challenging element of KYC/AML compliance. Our entity hierarchy feature helps untangle the network of interconnected companies and individuals through a clear and intuitive visual interface, identifying ultimate beneficial owners (UBOs) with ease and drilling down into individual entities. It will help you uncover potential red flags and hidden connections that manual investigations might miss.

Qkvin's customisable workflows adapt to the unique needs of your organisation, streamlining case management and ensuring a frictionless experience. Qkvin eliminates confusion through clear instructions, automated notifications, and intuitive interfaces. Our solution integrates seamlessly with existing systems for a unified view of the client journey. Qkvin delivers actionable insights from real-time data to continuously improve onboarding processes and exceed client expectations.

Once onboarded, Qkvin continuously monitors for changes from customers or integrated data sources and screening to identify any potential impact on the client's risk profile. Through real-time transaction monitoring, automated data refresh, tailored monitoring rules and customisable alerts, Qkvin helps monitor your risk exposure in real time.